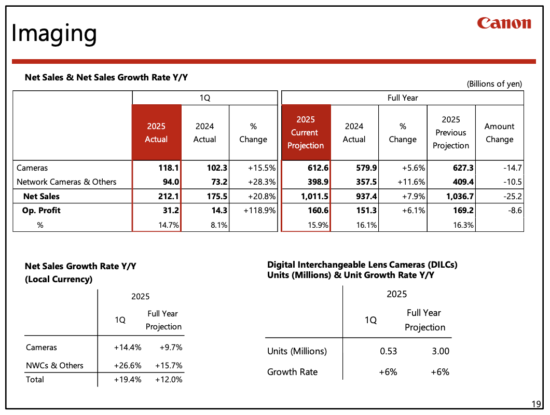

Canon released their Q1/2025 financial report:

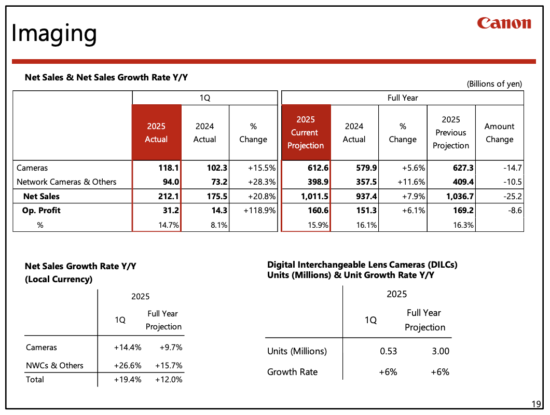

Canon Imaging Business Unit financial results recap:

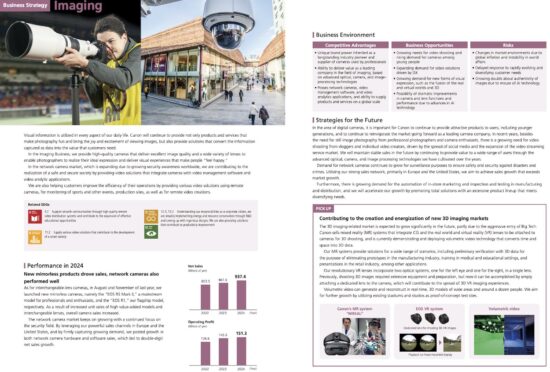

In the Imaging Business Unit, sales of interchangeable-lens digital cameras increased substantially thanks to the healthy inventory levels and continued to experience strong sales of the EOS R5 Mark II, which was launched in the second half of the previous year. Sales of network cameras also increased as the market grew steadily. As a result, sales for the first quarter of the Imaging Business Unit increased by 20.8% compared with the same period of the previous year to ¥212.1 billion, while income before income taxes for the first quarter increased by 116.8% compared with the same period of the previous year to ¥32.3 billion.

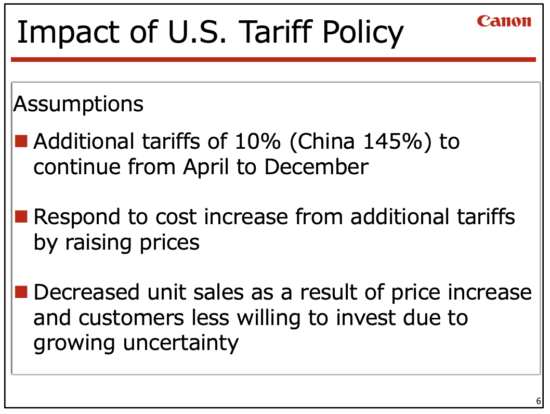

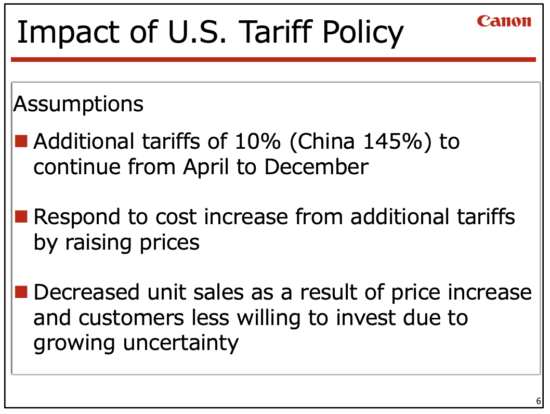

Canon also released a separate Q&A document regarding the upcoming/proposed tariffs and confirmed the previously rumored price increase:

Q: If you look at the impact of U.S. tariffs by segment, what is the order of magnitude?

A: The order of magnitude of tariff impact by segment is proportional to the sales volume in the United States. A rough breakdown of sales shows that Printing accounts for about 60%, Medical for about 10%, and Imaging for about 25%.

Q: Please talk about the status of the price increase. If additional tariffs are passed on to product prices, how much of a price increase will we see in the end market?

A: We have notified major dealers that we will raise prices and are in the process of estimating the timing and amount of the increase. Since tariffs are borne against the cost of goods, the higher the cost ratio is, the higher the price rate increases. We will conduct a detailed analysis, including the cost of each product and where it is produced, and will determine the rate of price increase for each product.

Here is the recap of the Canon Q1/2025 financial report:

-

Market Performance: The Imaging Business Unit, which includes cameras and lenses, accounted for approximately 25% of Canon's U.S. sales, making it a significant segment affected by U.S. tariffs.

-

Price Increases: The unit is implementing price increases due to rising production costs, inflation, supply chain challenges, and additional tariffs, with the exact rate varying by product based on cost ratios and production location.

-

Tariff Impact: Canon expects a competitive advantage in the camera market due to its higher production in Japan compared to competitors who rely more on China, where tariffs are higher (e.g., 145% on Chinese exports).

-

Sales Volume Strategy: Despite potential sales volume declines due to price increases, Canon believes it can redirect backordered products like cameras to other regions if U.S. shipments are impacted, minimizing overall sales loss.

-

Inventory Management: The U.S. sales subsidiary holds 1-2 months of inventory, which was factored into tariff cost projections, with the main tariff impact expected in the latter half of 2025 as inventory depletes.

-

Competitive Landscape: Canon faces intense competition from Sony and Nikon in the mirrorless market but aims to maintain its edge through strengths in autofocus technology and its lens ecosystem.

Breaking: Canon to increase prices in the US as a result of the new Trump tariffs

Source: Canon

The post Canon released their Q1/2025 financial report: price increase confirmed appeared first on Photo Rumors.

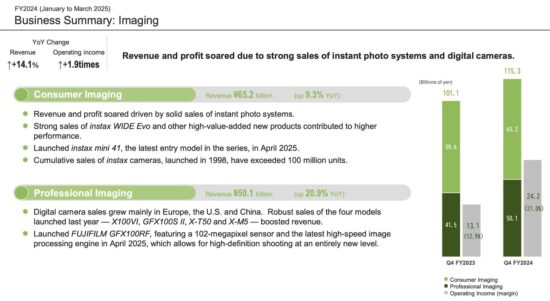

instant photo systems contributed to the increase in revenue.

instant photo systems contributed to the increase in revenue.