Intel's Open Source Future in Question as Exec Says He's Done Carrying the Competition

Read more of this story at Slashdot.

Read more of this story at Slashdot.

Read more of this story at Slashdot.

Le partenariat annoncé le 6 octobre 2025 entre OpenAI et le concepteur de puces AMD a fait bondir l’action du groupe à un niveau historique. Une alliance stratégique qui rebat les cartes d’un marché de l’IA dominé jusqu’ici par Nvidia.

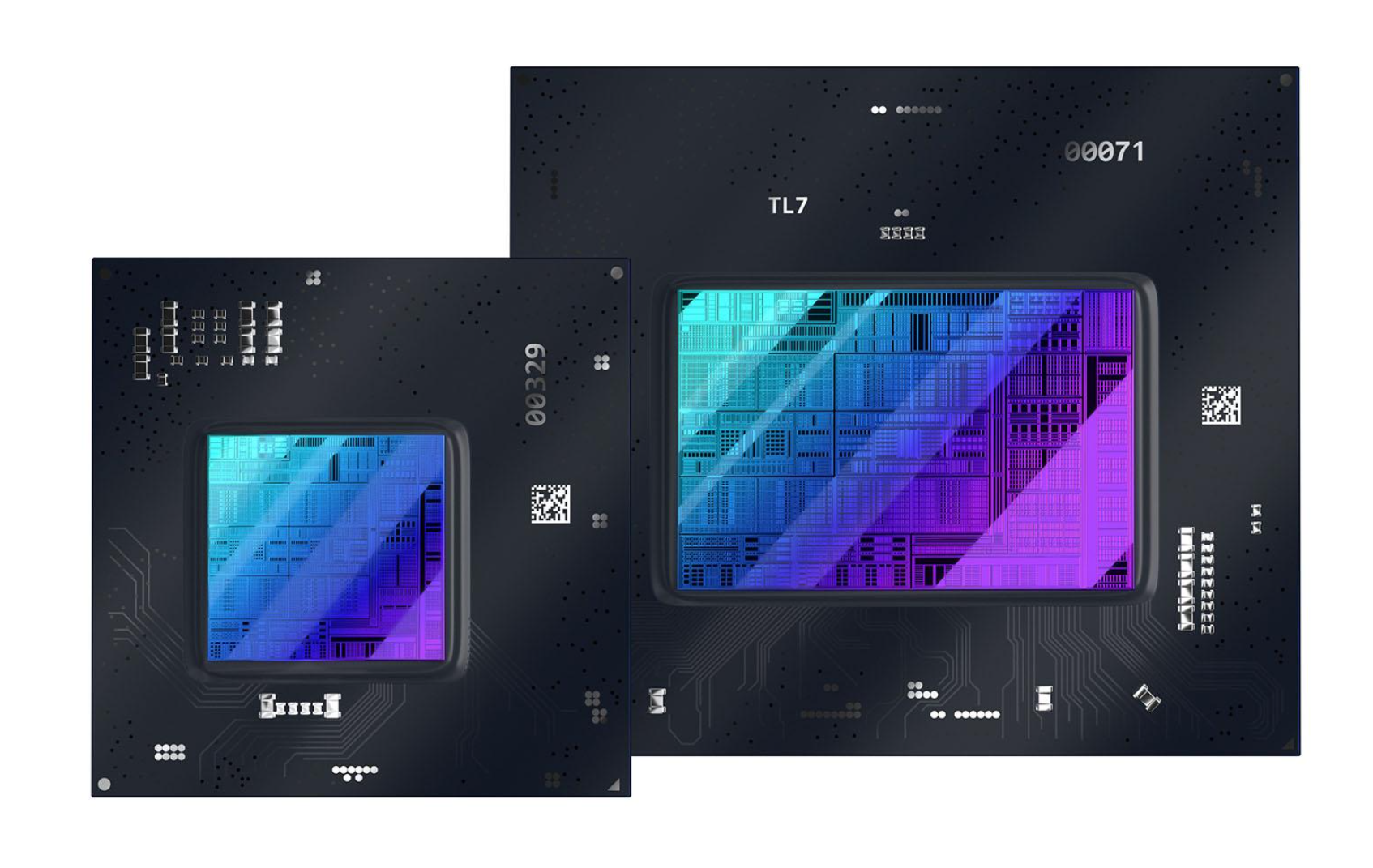

Intel confirme que sa technologie de gravure « 18A » est déjà en production dans son usine phare d’Arizona. Regroupant les unités 52 et 62, ce groupe industriel a reçu des crédits quasi illimités depuis 2021 avec une ligne budgétaire de 32 milliards de dollars instiguée par l’ancien PDG de la boite : Pat Gelsinger.

L’idée était de tout faire pour permettre à la marque de rattraper le retard accumulé face à son concurrent AMD. Se mettre à niveau technologiquement, conceptuellement et architecturalement en s’offrant notamment un outil de production à la fois puissant, extrêmement précis et fiable. Les déboires connus par les usines d’Intel boiteuses face à la production de certaines gammes de puces ayant couté fort cher au fondeur.

Aujourd’hui, les nouvelles semblent bonnes avec une Fab 52 qui produit déjà des wafers en 18A et pourrait arriver à une production de 1000 à 5000 wafers chaque mois à elle seule d’ici la fin de l’année. Avant de basculer sur une production de 15 à 30000 en 2026. De quoi lancer la production des prochains Core. Dont la génération Panter Lake attendue pour une présentation officielle dans les jours prochains. Les puces pourraient être présentes en petites quantités pour les fêtes de fin d’année et apparaitre en masse dès l’année prochaine.

Le 18A n’est pas qu’une finesse de gravure, c’est tout un ensemble de technologies qui devraient avoir deux effets majeurs pour la société. D’abord de pouvoir produire des puces plus rapides et moins gourmandes. Ensuite, la technologie pourrait largement séduire d’autres acteurs du marché qui chercheraient à faire graver leurs puces par Intel. On pense évidemment à Nvidia qui vient d’injecter énormément d’argent dans la structure.

Le 18A est vu comme une évolution technologique majeure pour Intel, un ensemble qui va bien au-delà de la simple finesse de gravure. Un des points clés est PowerVia. Un nom qui désigne un brevet permettant une alimentation différente du processeur. Aujourd’hui, les signaux et l’alimentation d’un processeur passent par le même chemin, ce qui pose de nombreux problèmes de fiabilité, de conception et de fabrication. Les transistors sont alimentés en énergie et transmettent leurs calculs par des chemins qui se longent. Un des atouts du 18A est d’utiliser une alimentation cheminant de l’autre côté du passage de l’information. Une fois maitrisée, cette technologie « backside power » permettra de meilleures performances, un argument consommation et une baisse du prix de revient des puces.

Autre bouleversement technique important, la mise en place du RibonFET GAA ou Gate-All-Around. Un nom barbare qui recouvre une technologie de transistors permettant de contrôler extrêmement finement l’usage du courant électrique. Ce courant qui traverse le transistor et qui est responsable de l’efficacité des calculs au sein des processeurs. Cette technologie permet non seulement de miniaturiser encore plus les divers éléments de chaque puce, mais également de réduire la consommation énergétique de l’ensemble. Cela permet de créer des puces plus denses et évite des tensions pouvant amener à des fuites de courants et donc des rejets de circuits.

Ces améliorations seront conjuguées avec la dernière version de la technologie Foveros Direct qui permet d’empiler les cœurs dans des technologies différentes au sein d’un même processeur. Ainsi que la technologie EMIB qui sera particulièrement utile pour mixer les composants et on pense évidemment à l’arrivée des solutions Core x86 RTX avec Nvidia. Pour rappel, c’est l’arrivée de la première génération EMIB qui avait fini par vendre la mèche de l’arrivée des puces Intel Core avec circuit graphique AMD Radeon en 2017.

Tout cela recoupe le calendrier proposé par Pat Gelsinger qui a mis en place la stratégie Intel Foundry destinée à séduire d’autres industriels pour qu’ils viennent graver leurs puces en 18A. Avec l’idée en tête de rentabiliser le coût de Recherche et développement et l’énorme investissement dans l’infrastructure des usines.

Intel entame la production de processeurs sous gravure 18A © MiniMachines.net. 2025

Read more of this story at Slashdot.

Intel a donc confirmé continuer à développer ses puces Arc en parallèle du développement de ses puces construites en collaboration avec Nvidia. Les Intel x86 RTX et les circuits Arc n’entrent finalement pas vraiment dans le même canal de distribution.

Je vous parlais de pragmatisme dans mon billet sur les Intel x86 RTX et c’est le maitre mot pour comprendre la situation. Aujourd’hui Intel n’arrive pas à lutter face à AMD et ses Radeon sur certains segments du marché. Des produits comme les puces Strix Halo d’AMD sont sans concurrence chez le fondeur. Chez Nvidia, les solutions RTX mobile en viennent aussi à se faire rattraper par les puces AMD. Pour proposer une alternative, Intel va donc travailler avec Nvidia comme la marque a pu travailler par le passé avec… AMD. Ce que l’on voit souvent comme un antagonisme entre des sociétés concurrentes n’est finalement que des décisions de business logiques.

Aujourd’hui la situation s’est éclaircie. Intel a d’abord indiqué continuer le développement de ses puces Arc. Leur feuille de route n’a pas changé et pour cause, ce ne sont pas vraiment les mêmes cibles que celles visées par les puces embarquées qui seront développées par la suite. Si on considère le délai nécessaire à la conception et la mise en place sur le marché des puces Intel/Nvidia, les propositions Arc ont largement leur place sur le calendrier. Il sera toujours temps de voir à terme l’état du marché lors de leur sortie.

D’un point de vue plus global, le segment des cartes graphiques Intel Arc n’est pas réellement une grosse épine dans la patte de l’éléphant Nvidia. Les parts de marché sont fiables voir souvent confondues avec la ligne du cadre des statistiques. Nvidia, de son côté, se porte très bien et fait également beaucoup d’ombre à AMD. Trop d’ombre même selon certains. Avec 94% du marché actuellement pour Nvidia contre 6% pour AMD, la survie du segment Arc est même importante pour le géant graphique. Le risque d’une plainte et d’un démantèlement pour des raisons de concurrence étant bien présent, l’existence d’un troisième larron sur ce segment est aussi une sécurité pour la marque.

Aujourd’hui, on apprend qu’Intel cherche à embaucher un ingénieur dont le rôle sera d’optimiser les compétences en jeu des futures plateformes Arc. Preuve que la marque continue bien son développement technique sur ce segment. Le plan d’Intel sur ce segment était prévu dès le départ comme une vision à très long terme. La marque savait dès le lancement de la gamme que la bataille serait perdue les premières années. Il est impossible de sortir gagnant d’un test face aux concurrents actuels sur ce marché avec si peu d’expérience.

Intel a donc deux possibilités, soit poursuivre la stratégie entamée et compter sur ses déploiements futurs pour proposer des puces plus compétentes. Il ne s’agit pas d’être forcément plus rapide que la concurrence, il suffit d’être assez rapide, efficace et abordable pour venir grignoter des parts à AMD et Nvidia sur ce segment. Soit arrêter les frais maintenant. Cela permet d’éviter des dépenses, mais couterait également des années d’investissement en pure perte sur le secteur. Intel semble avoir choisie la première voie. Celle qui consistera à proposer des puces avec Nvidia d’un côté et des puces graphiques indépendantes ayant d’autres intérêts de l’autre.

Intel poursuivra le développement de ses puces graphiques Arc © MiniMachines.net. 2025

Read more of this story at Slashdot.

Read more of this story at Slashdot.

En échange d'un investissement de 5 milliards de dollars, Nvidia va devenir un des plus grands actionnaires d'Intel, en crise depuis quelques années. L'action Intel pourrait s'envoler de +30 % à l'ouverture du marché, alors que la Maison-Blanche a aussi racheté 10 % de l'entreprise.

Read more of this story at Slashdot.

Read more of this story at Slashdot.

Avec la gamme NAS Qu, QNAP va se distinguer en proposant des puces permettant de développer des capacités de calcul plus évoluées que précédemment. Ce n’est pas la première fois que la marque emploie des puces Intel même si ses précédents modèles étaient sous processeurs Celeron Jasper Lake.

Ces Celeron sortis en 2021 ne paraissent pas spécialement éloignés, pourtant la différence de performance développée entre un Twin Lake N150 et un Jasper Lake comme le N5100 est flagrante. Les QNAP Qu pourront piloter beaucoup plus de choses et en particulier de fonctions virtualisées et dockerisées.

Pour le moment, ces modèles sont testés sur le marché Chinois et je ne serais pas surpris qu’ils envahissent tous les rayons. On a vu ces derniers trimestres que de nombreux fabricants de MiniPC étoffaient leurs gammes avec des solutions proposant plusieurs éléments de stockage à la manière d’un NAS. Venant ainsi concurrencer de manière plus ou moins parfaite ce marché. La réponse de QNAP est ici assez simple, rehausser les performances de sa gamme avec un engin équipé de puces habituellement intégrées à des MiniPC.

Avec quatre, six ou huit baies et des processeurs allant du N150 au Core 3 N355, ces NAS Qu vont pouvoir proposer une alternative conforme aux attentes du public en termes de stockage réseau. D’autant qu’ils reprennent à leur compte une bonne partie des besoins classiques des MiniPC. Ici point de mémoire soudée, mais un emplacement SODIMM de DDR5 qui pourra officiellement accueillir 16 Go. Un stockage de base de 8 Go de eMMC pour un système embarqué mais également deux ports M.2 2280 NVMe PCIe Gen 3 x1 pour accueillir données, systèmes virtualisés ou accélerer les performances des disques mécaniques. Et, évidemment, de quatre à huit baies 2.5/3.5″ SATA3 pour abriter des unités de stockage.

Le reste de la connectique est commun avec un double port Ethernet 2.5 Gigabit, un USB 3.2 Type-C, deux USB 3.2 Type-A et même une sortie HDMI 2.1. A noter que le constructeur ne distribuera pas ses QNAP Qu sous forme de Barebones mais bien pré-équipés en mémoire vive. Les modèles recevront ainsi de 8 à 16 Go de DDR5 en usine.

On imagine assez facilement l’intérêt de ces solutions sur le marché. Le prix des puces Intel n’est pas élevé, leurs possibilités sont très large et une foule de solutions logicielles tournent dessus. Un Qnap Qu405 en quatre baies pourrait ainsi être proposés avec QuTS Hero, le système du fabricant sur son eMMC de 8Go et toucher le grand public. Mais ce logiciel permettra également de déployer de manière plus avancée des systèmes de containers et de virtualisation, ce qui permettra aussi bien d’installer un Windows ou un Linux sur un des SSD internes. Ou d’utiliser des solutions Docker pour d’autres outils. L’utilisateur avancé pouvant ainsi profiter d’un matériel aux finitions techniques irréprochables tout en exploitant une solution logicielle réellement sur mesures avec un système performant.

Pas d’informations quant à une disponibilité en France ni de prix pour le moment.

QNAP Qu : De nouveaux NAS sous puces Intel Twin Lake © MiniMachines.net. 2025

Read more of this story at Slashdot.

Read more of this story at Slashdot.

Read more of this story at Slashdot.

Read more of this story at Slashdot.

Read more of this story at Slashdot.

Read more of this story at Slashdot.

Read more of this story at Slashdot.

Read more of this story at Slashdot.